Calculate ebitda margin

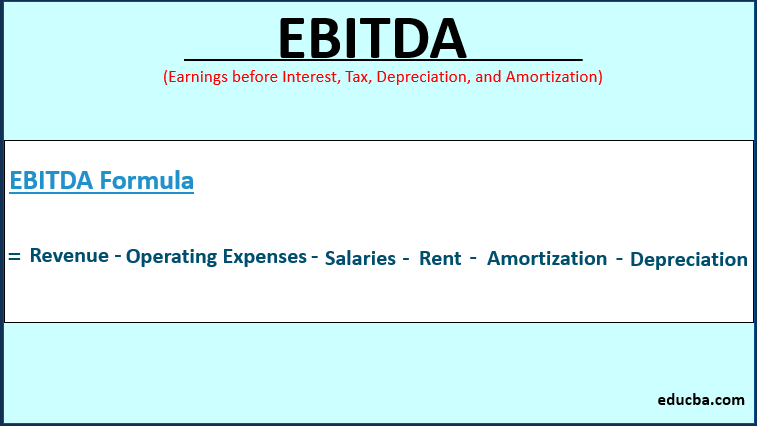

The formula for an EBITDA margin is as follows. Net Profit Margin Net Income.

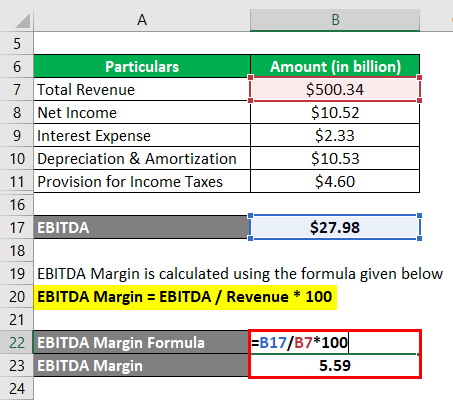

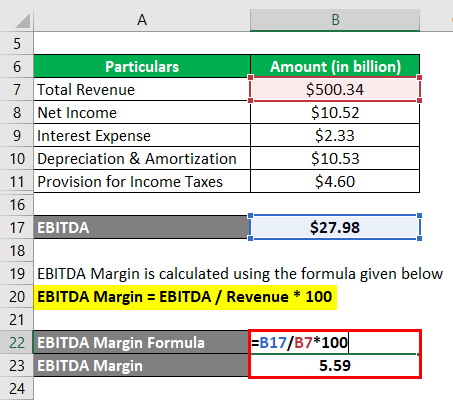

Ebitda Margin Formula And Calculator Excel Template

Start with a companys annual SEC Form 10-K or quarterly 10-Q report filed with the US.

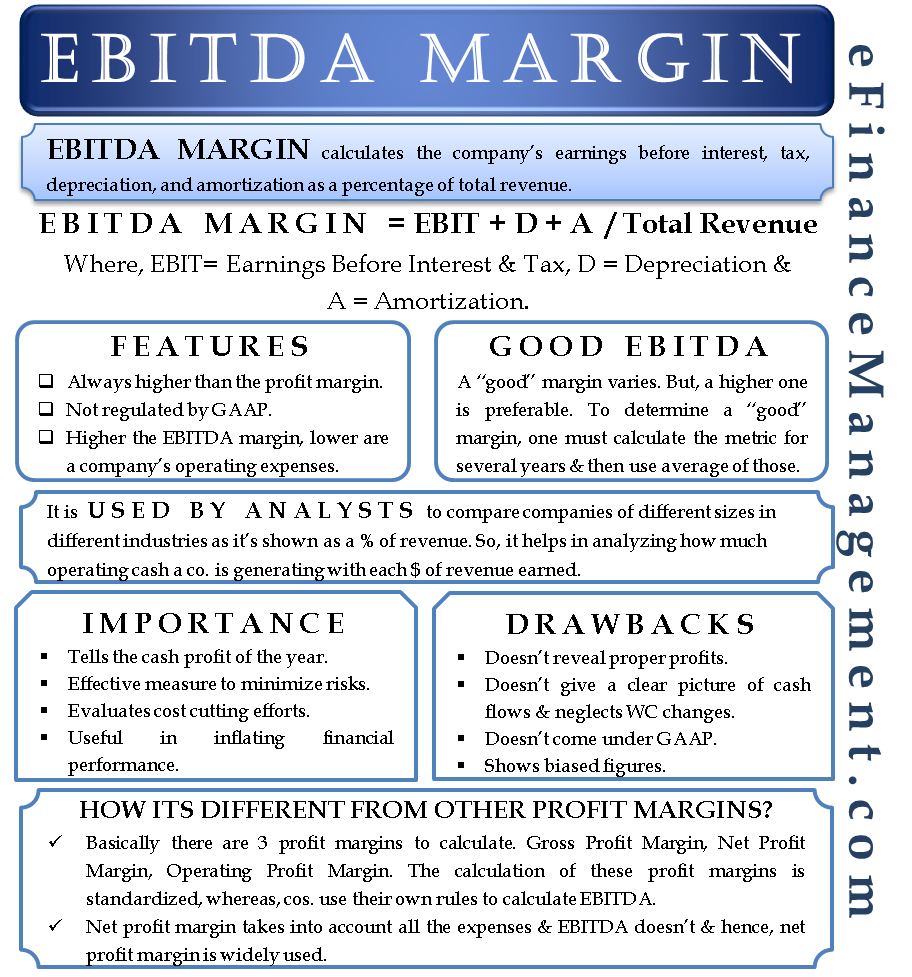

. Profit Margin Formula. A good EBITDA margin is largely dependent on the industry. Margin ratios represent the companys ability to convert sales into profits at various degrees of measurement.

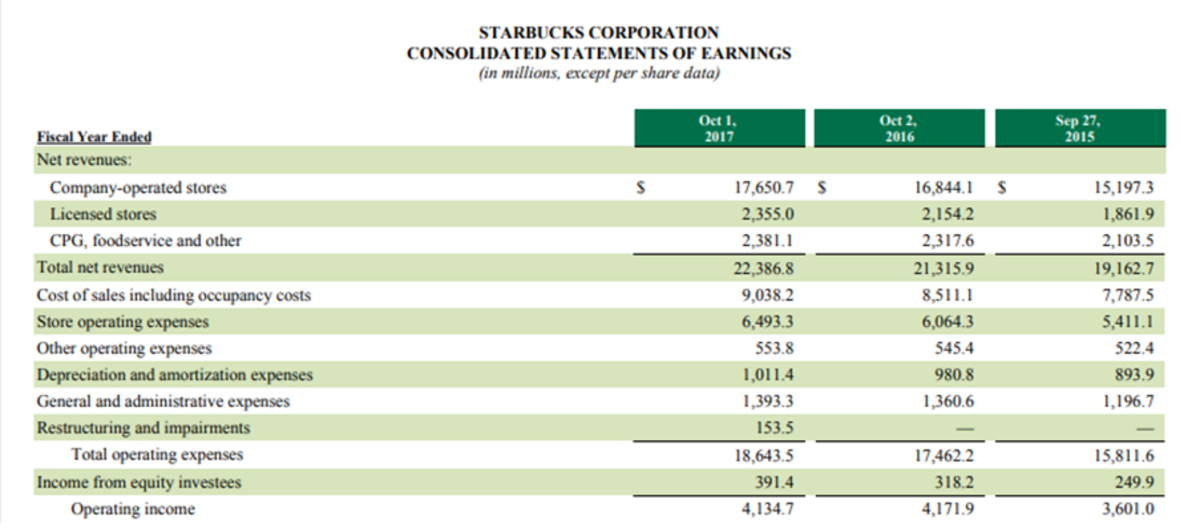

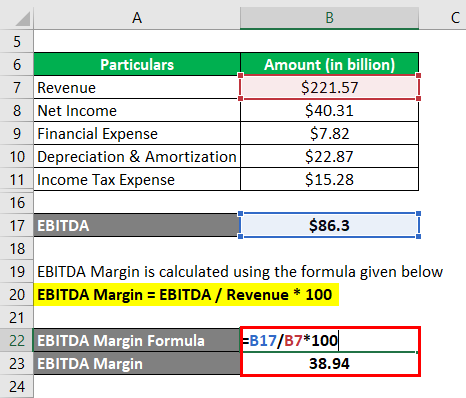

The following chart shows how to calculate Starbucks EM for fiscal. When assessing the profitability of a company there are three primary margin ratios to consider. Gross Margin 38.

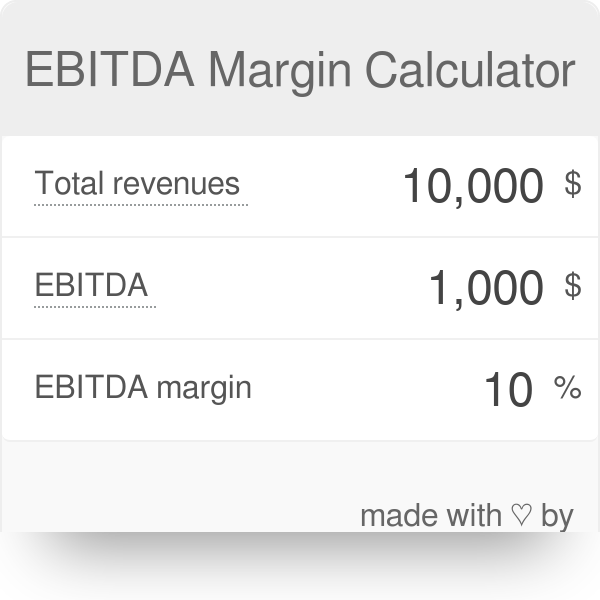

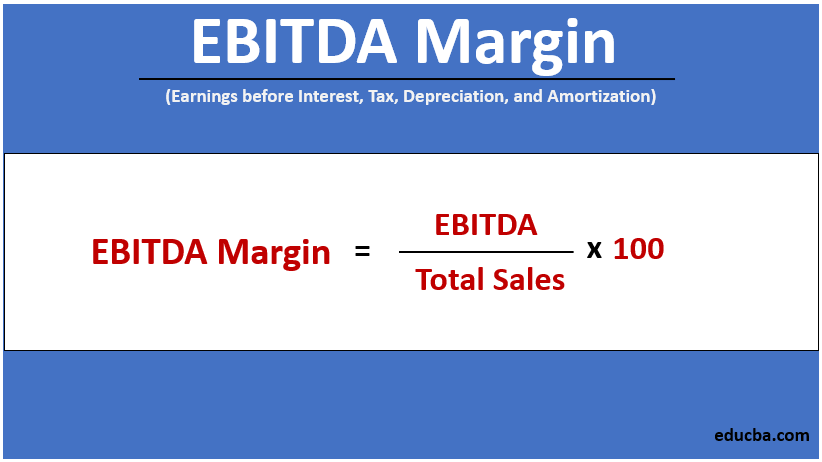

EBITDA margin is a measurement of a companys operating profitability as a percentage of its total revenue. How to Calculate EBITDA. EBITDA Margin EBITDA Net Sales.

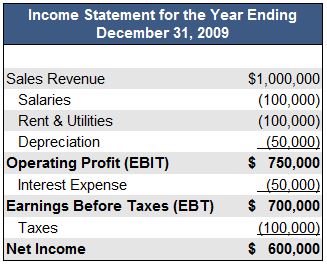

An example will serve to illustrate how to calculate the EBITDA margin. It is calculated by. Update your mobile number email Id with your stock brokerdepository participant and receive OTP directly from depository on your email id andor mobile number to create pledge.

June 21 2018 at 755 am. Calculate Bombardier Incs EBITDA during the financial year based on the given information. Of course we can still calculate our overall margin but this formula sets us up to calculate margins by revenue stream.

However in 2015 Colgates EBIT Margin EBIT Margin EBIT Margin is a profitability ratio that is used to determine how successfully and efficiently a business can manage its operations. We can directly calculate the effective tax rates Calculate The Effective Tax Rates Effective tax rate determines the average taxation rate for a corporation or an individual. The practice of companies disclosing non-GAAP earnings to offer more insight into their recent operational performance and financial position has become rather common in recent years.

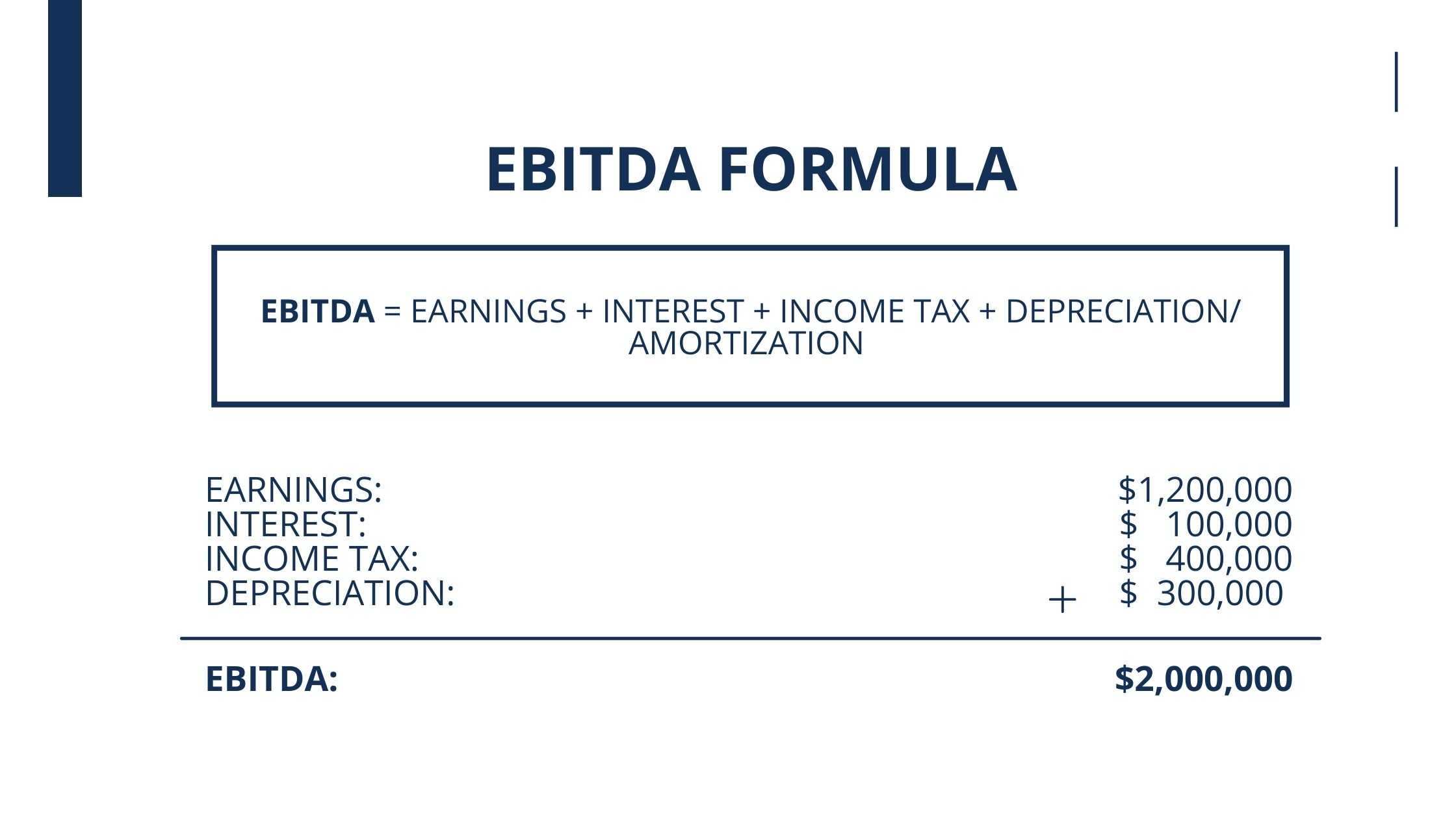

EBITDA margin EBITDA Total Revenue. Let us take the real-life example Bombardier Inc. EBITDA Net income interest expenses tax depreciation amortization.

It is equal to earnings before interest tax depreciation and amortization EBITDA. Read more decreased significantly to 174. Stock Brokers can accept securities as margin from clients only by way of pledge in the depository system wef.

Gross operating and net. The generally applied term profit margin can be broken down into three categories. EBITDA margin Analysts will often use EBITDA to calculate a companys EBITDA margin.

EBITDA stands for Earnings Before Interest Taxes Depreciation and Amortization. EBITDA margin accounts for profit margin while adding back in depreciation and amortization. This is a valuable financial metric because it allows you to compare the relative profitability of companies of.

By determining a percentage of EBITDA against your companys overall revenue this margin gives an indication of how much cash profit a business makes in a single year. For the year ended. EBI Earnings Before Interest Expense.

The gross margin equation expresses the percentage of gross profit Percentage Of Gross Profit Gross profit percentage is used by the management investors and financial analysts to know the economic health and profitability of the company after accounting for the cost of sales. Securities and Exchange Commission. To find out if your EBITDA margin is any good its worthwhile to.

Very focused on the rule of 40 right now. EBITDA total revenue EBITDA margin For example lets say Company A has an EBITDA of 500000 along with a total revenue of 5 million. Examples are gross profit margin.

TTM EBITDA in Ratio Analysis 1 TTM EBITDA Margin. The formula is as follows. The goal in doing so is to provide enhanced transparency into the.

EBITDA stands for E arnings B efore I nterest T axes D epreciation and A mortization. RD expenses should be below gross margin in operating expenses. LMN company declared a net profit before taxes and interest of 3M for year-end 2015.

It represents the profitability of a company before taking into account non. How to Calculate EBITDA Margin. What is a Good EBITDA margin.

Does LTM EBITDA Margin EBITDA Margin EBITDA Margin is an operating profitability ratio that helps all stakeholders of the company get a clear picture of the companys operating profitability and cash flow position. So that you can easily see your EBITDA performance. You may also look at the following articles to enhance your financial skills.

500000 5000000 10. If your business has a larger margin than another it is likely a professional buyer. EBITDA was 2080 billion and the EBITDA margin was 1376.

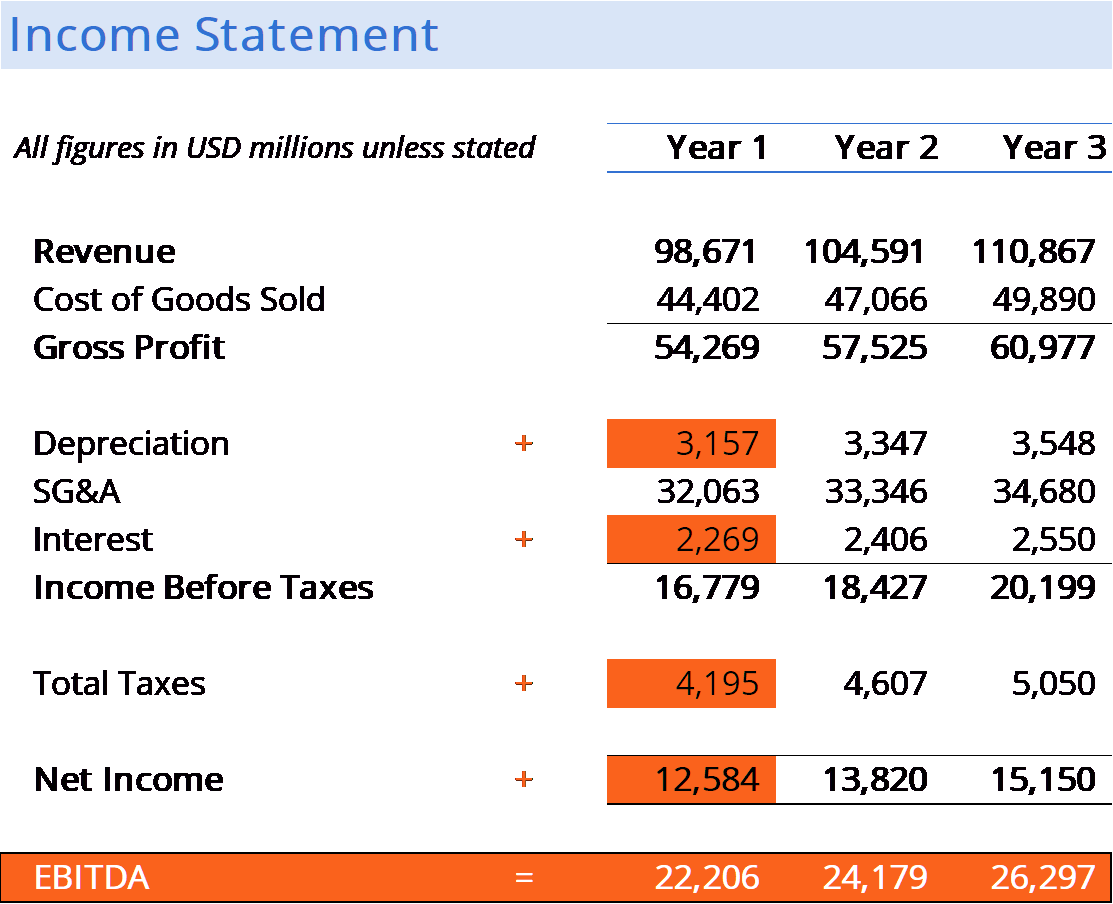

This margin reflects the percentage of each dollar of revenue that remains as a result of the core. Gross Profit Margin Gross Profit Revenue x 100. EBITDA Operating Income EBIT Depreciation Amortization.

Here we discuss the formula to calculate Contribution Margin and practical examples and excel templates. Let us now calculate the tax rate required for calculating NOPAT. To compute the EBITDA ratio the following formula is used.

How to calculate EBITDA. EBITDA is very simple to calculate. To learn more launch our online finance courses now.

The basic EBITDA formula is. These margins can be compared to those of competitors like Lowes LOW to measure the relative operating efficiency of the businesses. But the average EBITDA margin for the SP 500 in the first quarter of 2021 stood at 1568Looking closer into individual companies the EBITDA margin of Coca-Cola during the fourth quarter of 2020 stood at 983.

Gross Margin Formula Example 2. For both there is a similar formula only with variation in considering variables. Consider the following facts from the 2017 annual report of Starbucks.

Operating Profit Margin Operating Profit Revenue x 100. As per the annual report published for the year ending December 31 2018 the following information is made available from the income statement. EBITDA margin or an EBITDA valuation metric such as EVEBITDA is much more useful when comparing companies.

How to Calculate EBITDA Margin in Excel The EBITDA margin is the EBITDA divided by total revenue. Defined Contribution Plan Example. It is calculated by dividing the companys earnings before interest taxes.

Below is a breakdown of each profit margin formula. Let us see the EBITDA Margin calculation The EBITDA Margin Calculation EBITDA Margin is an operating profitability ratio that helps all stakeholders of the company get a clear picture of the companys operating profitability and cash flow position. Again however a good EBITDA margin or valuation metric will depend on the industry.

This has been a guide to the Contribution Margin and its meaning. The most common way to calculate your EBITDA margin is by starting with your net income and then adding back in the figures for any interest youre incurring plus taxes depreciation and amortization.

What Is Ebitda Formula Example Margin Calculation Explanation

How Do I Calculate An Ebitda Margin Using Excel

What Is Ebitda Formula Example Margin Calculation Explanation

Ebitda Margin Features Importance Drawbacks Other Profit Margins

Ebitda Margins What Every Small Company Owner Needs To Know

What Is An Ebitda Margin Examples And How To Calculate Thestreet

Ebitda Types And Components Examples And Advantages Of Ebitda

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

Ebitda Margin Formula And Calculator Excel Template

What Is Ebitda Formula Definition And Explanation

Ebitda Margin Calculator

How To Calculate Ebitda Margin

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin

Sjcomeup Com Calculator Ebida

What Is An Ebitda Margin Examples And How To Calculate Thestreet

Ebitda Margin Template Download Free Excel Template

Ebitda Margin Definition Advantages And Limitations Of Ebitda Margin